Are Moving expenses tax deductible? This is one of the most popular moving related questions that few people seem to have the answer to. Luckily, American Van Lines is here to help. In short, the answer is No. In 2017 (Tax Cuts and Jobs Act (TCJA), a major tax overhaul got rid of the federal tax deduction for moving. However, there are still some exceptions and things you need to know regarding your upcoming move as it relates to taxes.

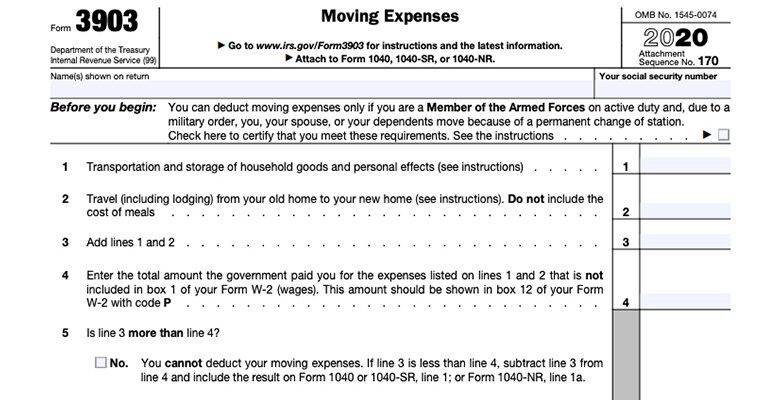

Can anyone still deduct moving expenses on their federal tax return?

Yes, if you’re an active member of the military, you still qualify for this (Form 3903, Moving Expenses). It is important to remember that if you’re a military member moving due to a permanent change of station, moving between duty stations, or you’re moving to a final station before retirement, you will be excluded from distance requirements. What are these distance requirements? In essence, in order for a move to be tax deductible, your destination or new address needs to be a minimum of 50 miles away from your old address. Additionally, you would need to start your new job/work assignment within a year of living for it to be considered tax deductible.

What kind of moving expenses are tax deductible?

There’s a lot of gray area around what exactly counts as tax deductible during the moving process. Here’s an easy way to think about it. Anything specifically related to your moving details counts. This includes packing supplies, the cost of your rental truck, the price of a storage unit and more. However, things such as the meals you buy as you travel cross country or a pillow you need for the truck to make your drive more comfortable do not count as things that are tax deductible during your move. Here’s another important note: if your employer reimbursed you for all of your moving expenses, they are no longer tax deductible. You’re not allowed to get reimbursed twice. Make sure you are honest about this to avoid issues and fees with the IRS.

How does this apply to state income tax returns?

As of January 2020, only seven states still allowed moving related expenses to be deducted. So if you live in Hawaii, Massachusetts, New Jersey, California, Pennsylvania, New York or Arkansas, you could be eligible for savings. Please note that each state has the power to change/update their rules regularly. To ensure that you’re making the right decisions, we strongly advise checking with a local tax advisor for any updates/advice on how to deduct your moving expenses.